WATCH ON DEMAND

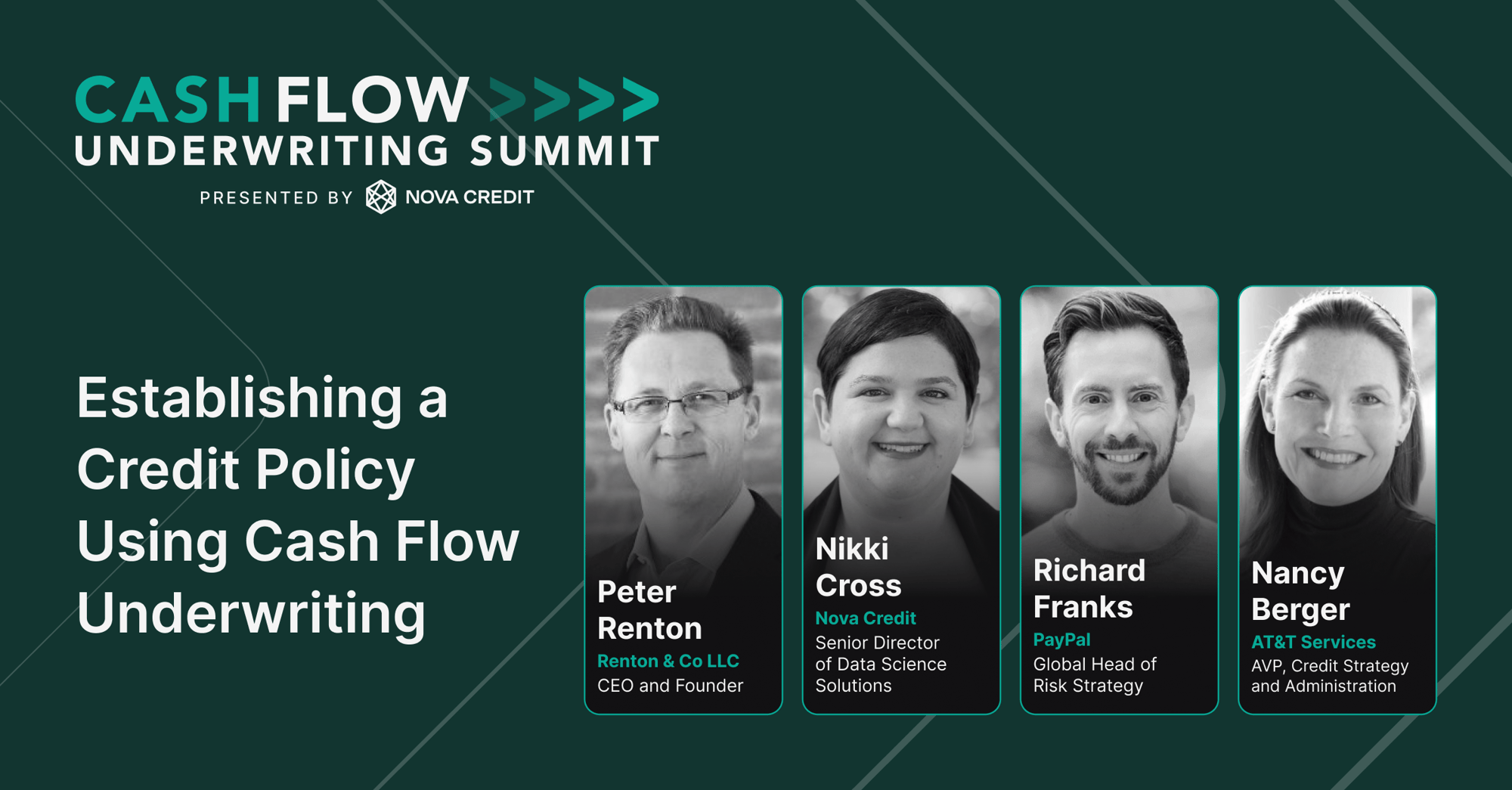

Establishing a Credit Policy Using Cash Flow Underwriting

Discover how innovative companies are transforming credit assessment by leveraging cash flow data in this insightful panel discussion. Moderated by Peter Renton, the session dives into real-world applications, challenges, and successes of using consumer-permissioned data to build smarter, more inclusive credit policies.

Watch Now

Key takeaways

- Consumer-Permissioned Data Shifts the Credit Paradigm: Cash flow data helps assess creditworthiness in real time, offering a fresh perspective beyond traditional credit scores. This data allows companies to understand consumers' financial behaviors even when historical data is limited, helping businesses to craft policies for a broader range of customers.

- Solving the "Cold Start" Problem: Companies need to implement strategies to overcome the challenge of implementing cash flow-based credit assessments without extensive historical data. By focusing on both operational needs and risk management, companies can ease into using new data sets and gradually improve underwriting accuracy.

- Expanding Credit Access Through New Data: AT&T has implemented practical steps to introduce cash flow data into their credit decisions. Starting small with controlled tests, they aim to enhance customer credit offers while ensuring robust decision-making based on real-time financial insights.

- Future of Cash Flow Underwriting: As the panel looks ahead, the consensus is clear: cash flow data will play a crucial role in the future of lending. By moving beyond FICO scores, financial institutions can offer more personalized and fair credit options, especially for thin-file or credit-invisible customers.

Watch all of the Sessions from Cash Flow Underwriting Summit

Watch all of the Sessions from Cash Flow Underwriting Summit

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay. Check out Cash Atlas™ solution.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.