WATCH ON DEMAND

Cash Flow Underwriting Summit 2024

Cash flow underwriting is quickly becoming a prominent growth strategy, offering numerous revenue-generating applications throughout the customer journey. Register to be one of the first to see the sessions from the Cash Flow Underwriting Summit as they become available.

Get the On-Demand Videos

Session Recordings Are Here

- WHY NOW

- GETTING STARTED

- LOOKING AHEAD

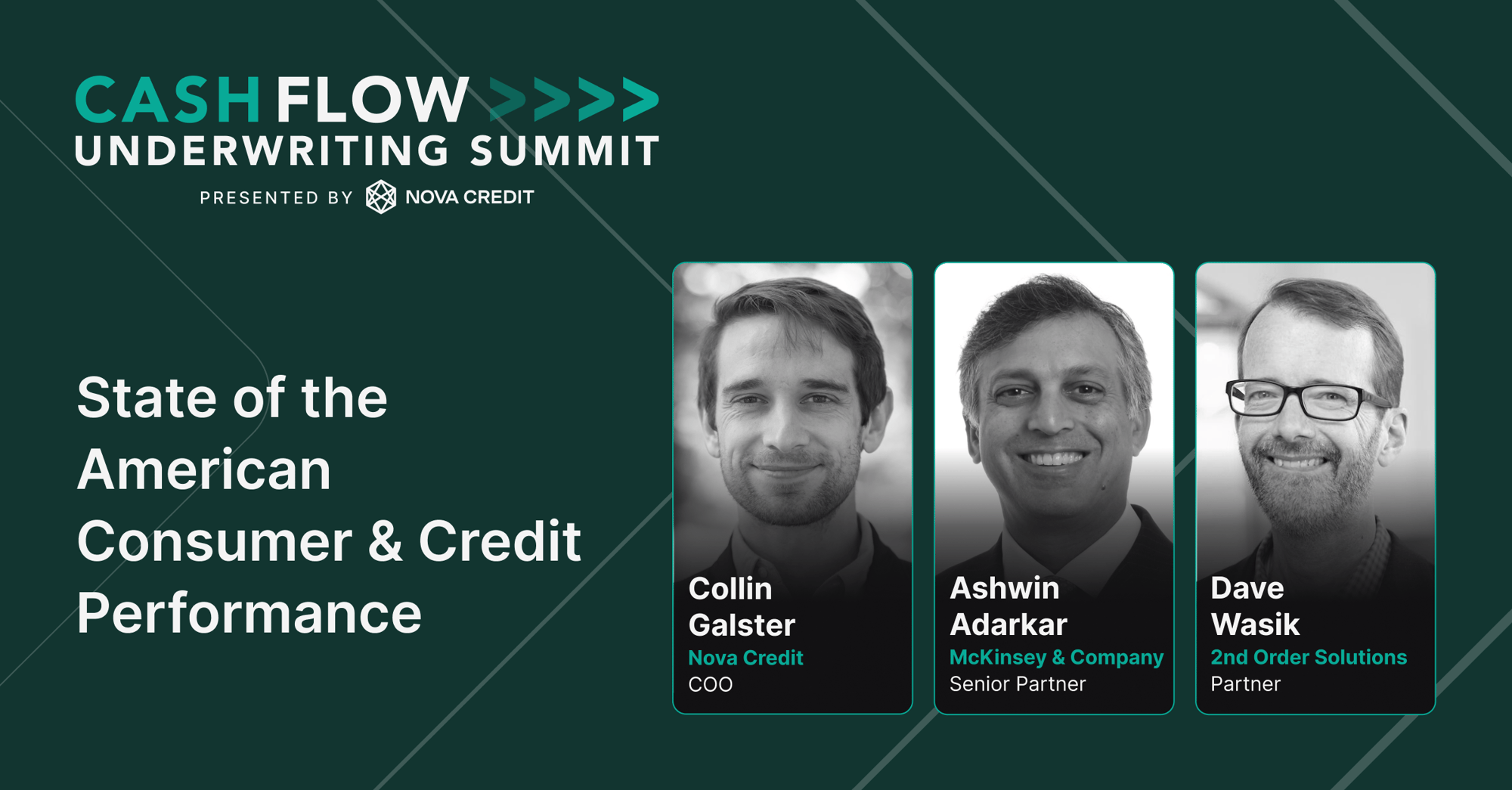

State of the American Consumer & Credit Performance

What does the economic cycle tell us about consumer credit today? What do consumer cash flows look like? How are consumers using credit in the U.S. and what product trends are we seeing? What unique borrower opportunities exist amidst a backdrop of economic expectations?

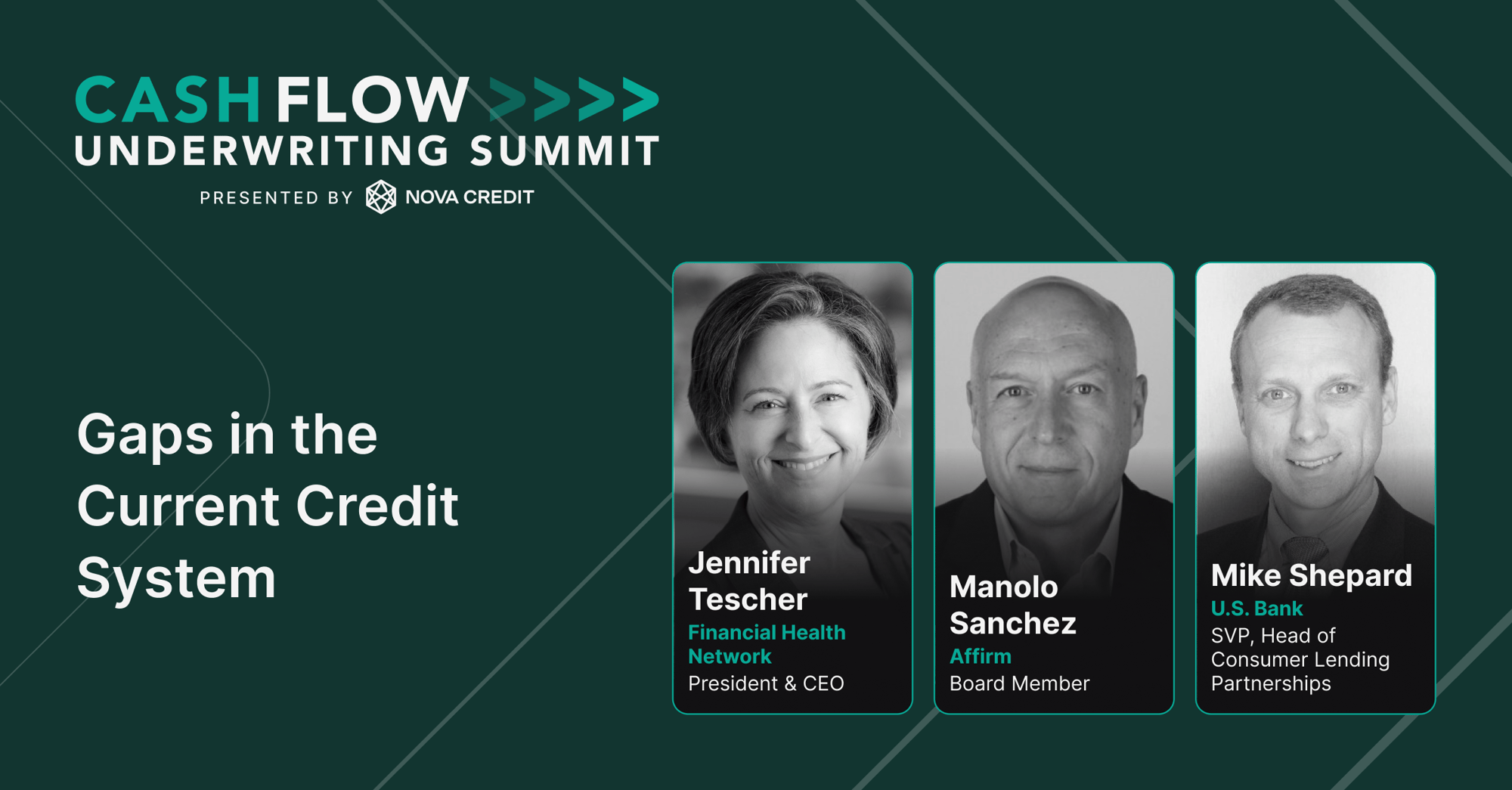

Gaps in the Current Credit System

While significant progress has been made over the last decade, some significant challenges persist in enabling credit access for millions in underserved segments. This session will focus on addressing the gaps in traditional credit data and exploring innovations like cash flow underwriting to enhance financial inclusion, with panelists reflecting on the progress, challenges, and opportunities in achieving financial equity.

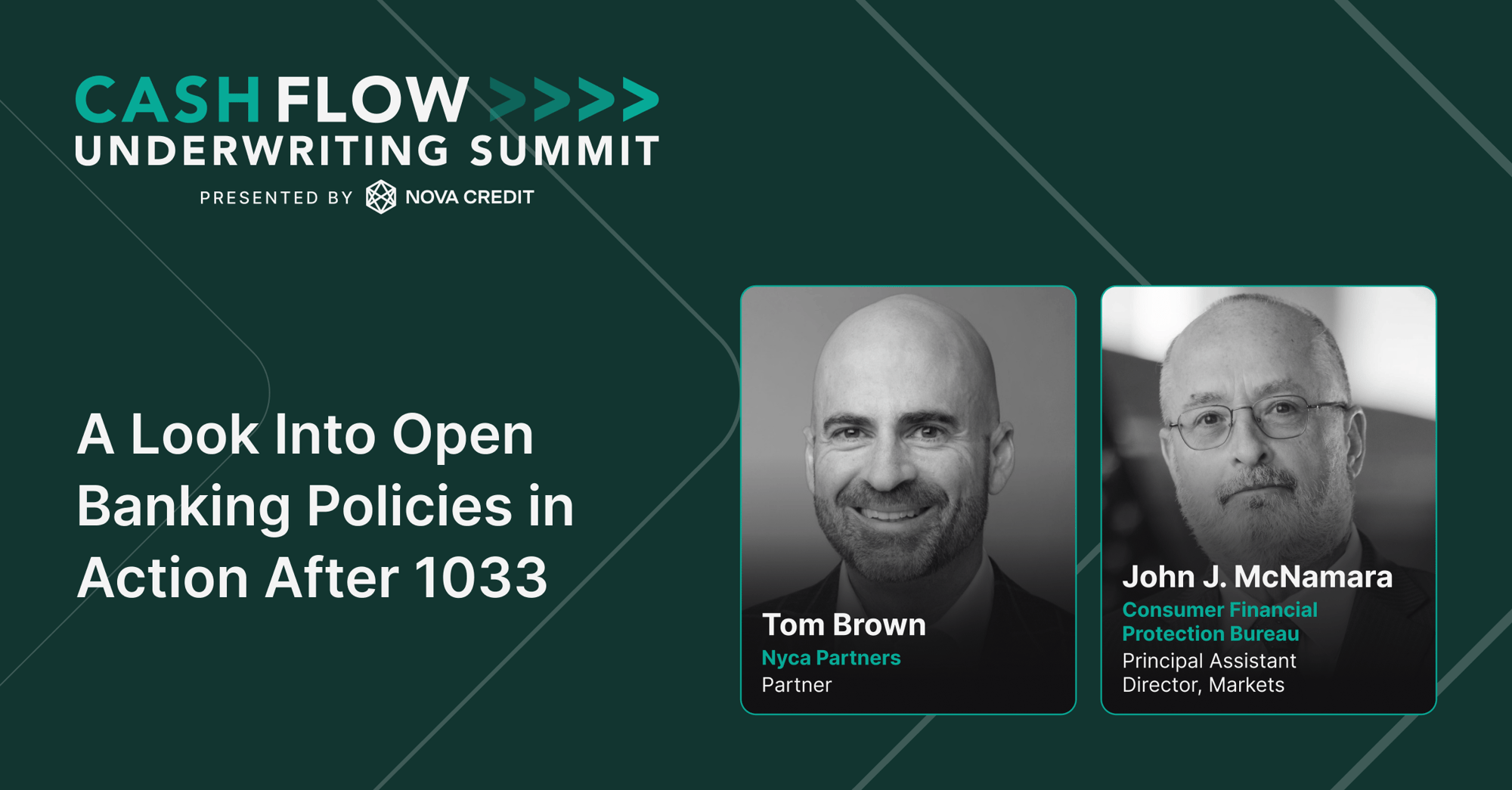

A Look Into Open Banking Policies in Action After 1033

As Section 1033 takes hold, we’ll speak with the CFPB about the upcoming impact of the regulation, unearthing expectations around compliance with the policies and understanding their vision for the future of open banking in the U.S.

Safety & Soundness During Regulatory and Economic Shifts

What does a cash flow driven future mean for the health of the financial services industry? Drawing on extensive experience in the regulatory and compliance sector, Gene will explore the balance between accuracy and automation, a financial institutions' role in consumer education, the evolving role of credit scores and alternative data like cash flow underwriting within financial institutions, and the competitive risks of not adopting emerging financial technologies.

Playing 3D Chess: Challenges with Attributes, Analytics, and Scores

How do cash flow analytics different from traditional credit processes? We will delve into the practical aspects of implementing cash flow-based scoring, comparing it with traditional credit scores, and offer guidance on deployment strategies, analytics in action, and decisioning processes. We will examine the necessary infrastructure and ROI education needed for successful implementation, addressing potential biases in scoring, and strategies for regulation of cash data.

The Cash Flow Journey: Key Applications to Get Started

With so many use cases, where do you begin? This session centers on the opportunities and challenges of implementing cash flow underwriting across various financial products, focusing on how to effectively apply cash data throughout the customer lifecycle. We’ll discuss strategies for initial applications, high-impact use cases, overcoming user experience and infrastructure hurdles, maximizing coverage and conversions, and explore some critical considerations for expanding beyond initial use cases.

Establishing a Credit Policy Using Cash Flow Underwriting

Dive into the world of consumer-permissioned data and how it is reshaping credit assessments. Panel will discuss how lenders can navigate the cold start problem, testing into the space, building versus partnering solutions, and the journey from early-stage implementation to long-term integration of cash flow data.

Steering Clear of Compliance Pitfalls

While cash flow underwriting may seem new, its foundations have been in practice for a number of years now. Join us for a dynamic session on the rules, regulations, and best practices of cash flow underwriting. Our panel of business, compliance and legal experts will share their insights on this evolving landscape. Discover how companies are overcoming the challenges and explore the future of cash flow underwriting in today's financial environment.

Open Banking in the U.S.

With new regulations, data pipelines, and powerful analytic applications, the U.S. is entering a period of profound innovation that will create significant opportunities for consumers and lenders. We’ll discuss developing a robust partnered ecosystem involving both private and public entities, how suppliers and financial institutions are adapting to this transition, exploring the shift from competition to cooperation in an open banking ecosystem, the role of analytics and infrastructure in maintaining a competitive edge, and the future of consumer credit and AI-driven personalized financial tools.

The Future of Credit for Everyday People: What’s Next with Credit Karma

Consumer credit has undergone a paradigm shift over the last decade, largely in part to the success Credit Karma has had innovating new lending products and designing new digital customer experience. As affiliate marketplaces play an increasingly dominant role in customer acquisition for lenders, Misha will sit down with Kenneth, to delve into his learnings from years building CK, the opportunities and challenges he sees for lenders, as well as a view into the future of consumer credit products.

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay.