WATCH ON DEMAND

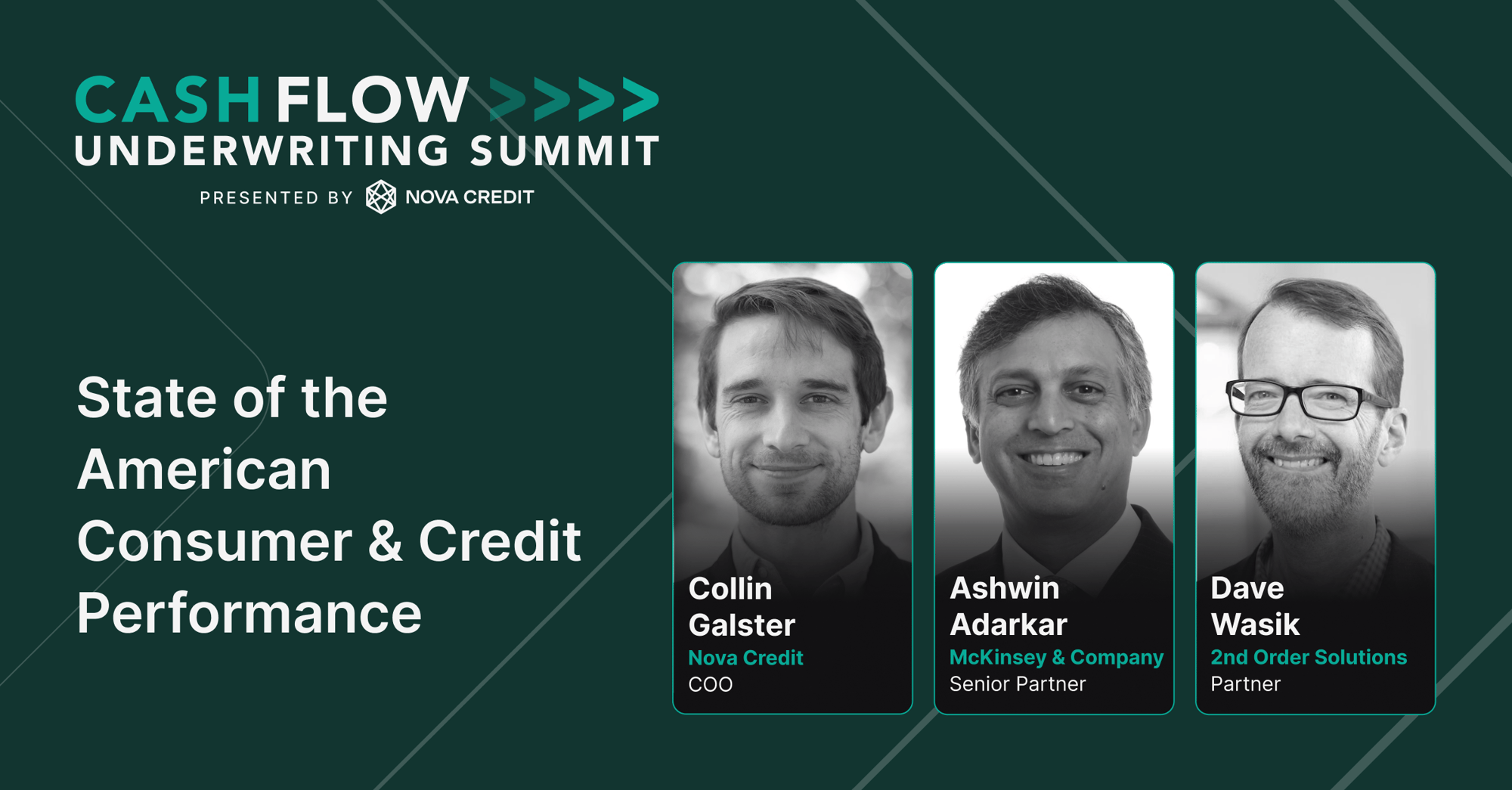

Fireside Chat - State of the American Consumer & Credit Performance

How are consumers using credit in the US and what does it tell us about the state of the economy? In this insightful fireside chat, industry leaders Colin Gaster (COO, Nova Credit), Ashwin Adarkar (Senior Partner, McKinsey & Company), and David Wasik (Partner, Second Order Solutions) come together to discuss the evolving state of consumer credit in the U.S. economy. They tackle the macroeconomic trends influencing lending, consumer behaviors, and how financial institutions can adapt to new challenges in credit performance.

Watch Now

Key takeaways

- Macroeconomic Shifts Are Impacting Credit: As consumers continue to face high credit balances, rising delinquencies, and tightening lending environments, banks and lenders can leverage cash flow underwriting as a powerful tool to address these emerging concerns.

- Credit Risk is Rising in Younger Generations: Younger generations are at risk of slipping into delinquency due to financial stress, and understanding these generational dynamics is critical for lenders aiming to make more informed credit decisions.

- Credit Builder and BNPL Products Offer New Opportunities: Both credit builder products and Buy Now, Pay Later (BNPL) solutions are reshaping the consumer lending landscape, but these products come with their own risks, especially as traditional lenders start to view credit builder products as potential indicators of consumer financial instability.

- Why Now for Cash Flow Underwriting? With new data sources and analytics tools becoming more accessible, cash flow underwriting is emerging as a vital method for lenders to better understand consumers with thinner credit files. This is especially relevant for assessing risk in underbanked populations and immigrants, who often lack extensive credit histories.

Watch all of the Sessions from Cash Flow Underwriting Summit

Watch all of the Sessions from Cash Flow Underwriting Summit

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay. Check out Cash Atlas™ solution.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.