WATCH ON DEMAND

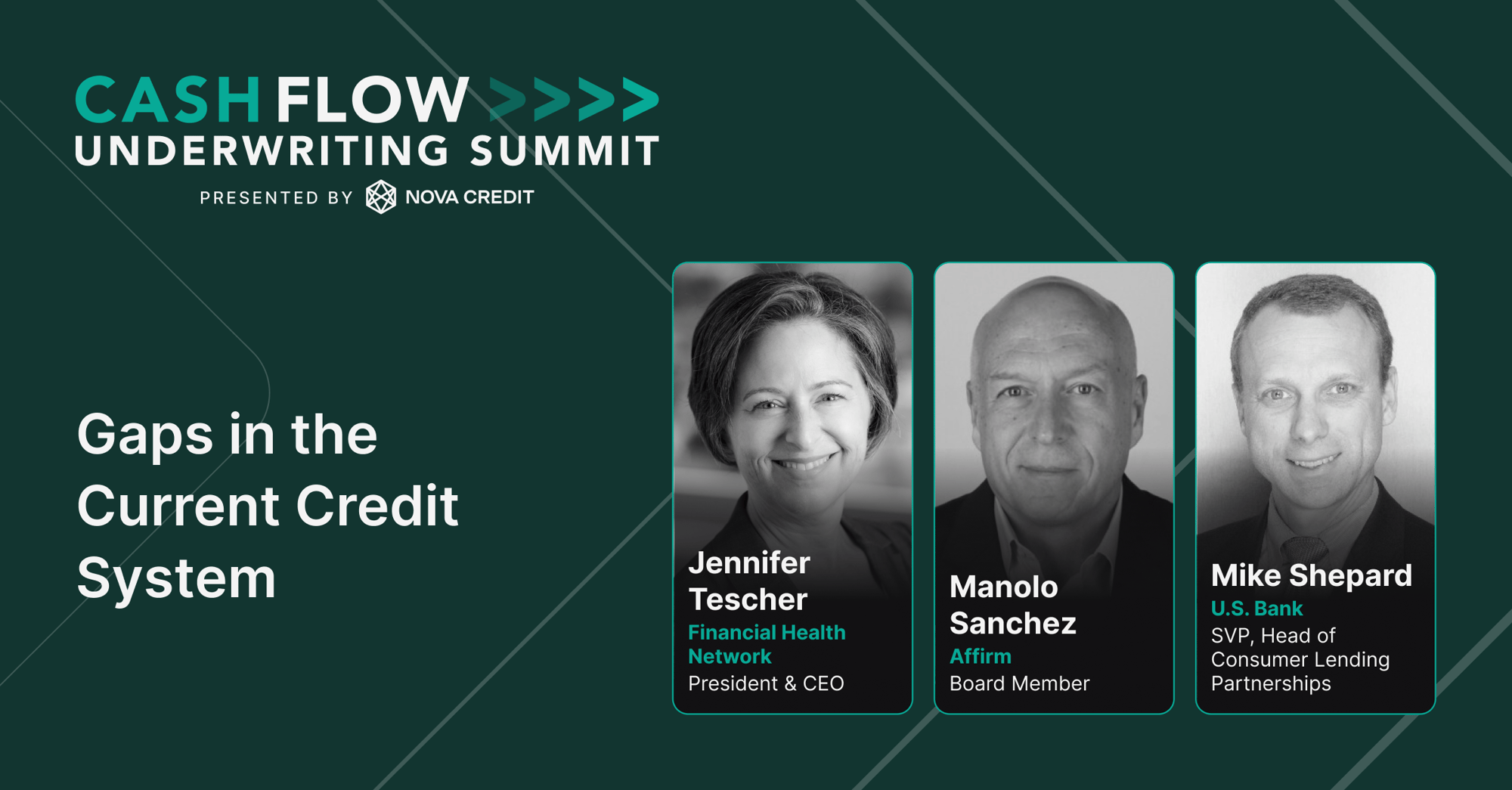

Gaps in the Current Credit System

In this enlightening panel, moderator Jennifer Tescher (President and CEO, Financial Health Network) and panelists Manolo Sanchez (Board Member, Affirm), and Mike Shepard (SVP, Head of Consumer Lending, U.S. Bank) explore the gaps in the current credit system, focusing on access, innovation, and the potential for cash flow underwriting to transform financial inclusion.

Watch Now

Key takeaways

- Bridging the Access Gap: The financial services industry has evolved and there have been strides towards expanding credit access. However, there is still a long way to go, particularly for consumers who are locked out of the credit system due to their limited credit history. There are ongoing efforts to leverage new data sources, such as rental payments, to broaden credit opportunities.

- Leveraging Technology for Inclusion: Fintech innovations are driving more financial inclusion. Companies like Affirm are using data-driven solutions, such as Buy Now, Pay Later (BNPL) services, to provide underserved consumers with access to credit. With better data management, fintechs are solving complex banking challenges, offering more personalized financial products to historically excluded populations.

- Innovative Lending Models: U.S. Bank's initiatives, such as their Simple Loan product, was designed as a consumer-friendly alternative to payday loans. By utilizing cash flow information and internal data, U.S. Bank is expanding access to small-dollar loans while maintaining responsible lending practices. This solution is not only addressing access but also reducing costs for consumers and improving overall financial health.

- The Role of Partnerships: All panelists underscored the importance of partnerships between traditional banks and fintech companies. These collaborations allow financial institutions to leverage innovative tools and data-driven insights to better serve their customers, particularly those who are overlooked due to traditional credit models.

Watch all of the Sessions from Cash Flow Underwriting Summit

Watch all of the Sessions from Cash Flow Underwriting Summit

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay. Check out Cash Atlas™ solution.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.