WATCH ON DEMAND

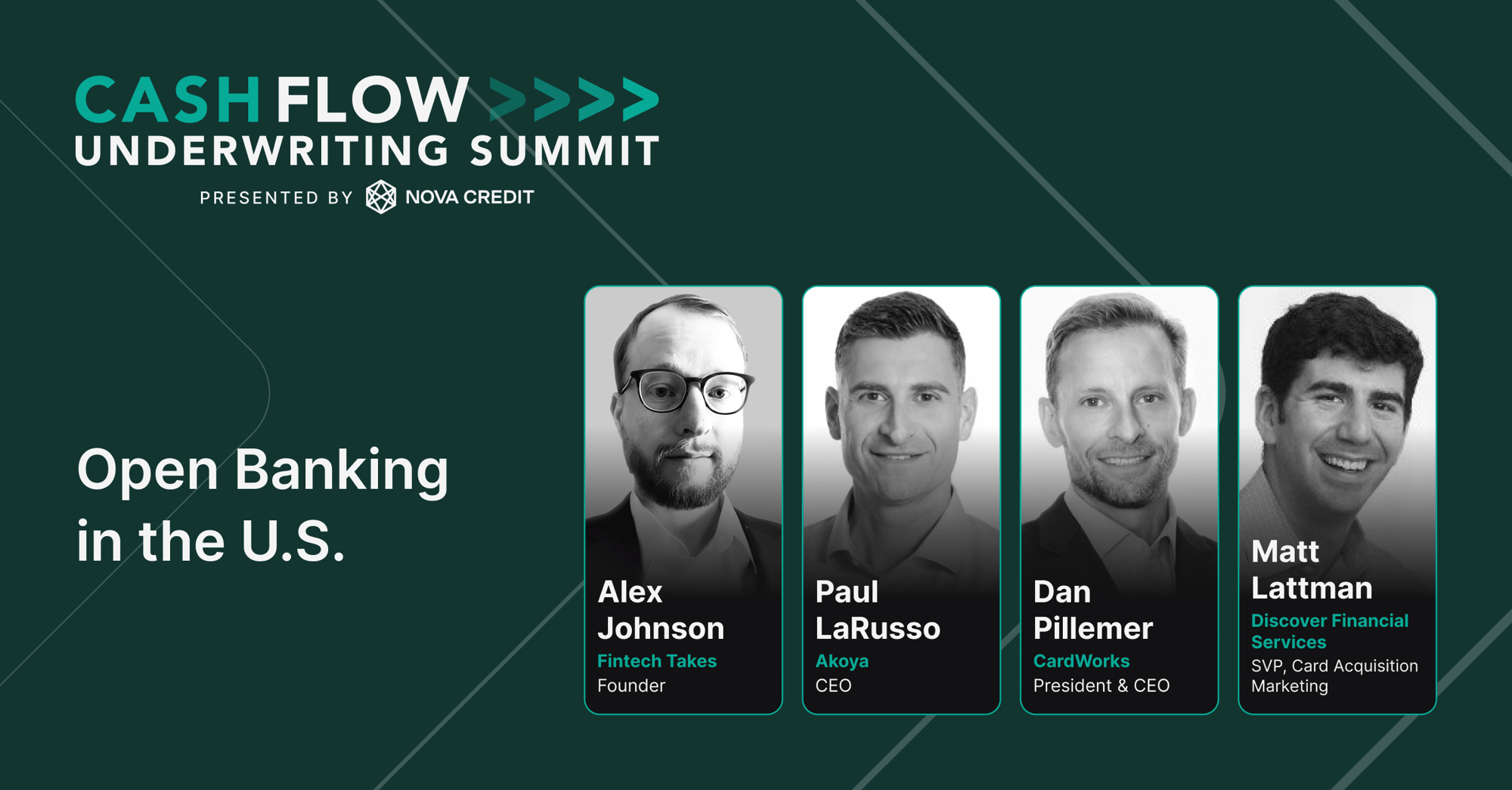

Open Banking in the U.S.

Join Alex Johnson (Founder, Fintech Takes) as he leads a thought-provoking panel featuring Paul LaRusso (CEO, Akoya), Dan Pillemer (CEO, CardWorks), and Matt Lattman (SVP, Discover) on the future of open banking in the U.S. This session digs deep into the challenges, opportunities, and transformations in data-sharing, compliance, and consumer empowerment in the financial landscape.

Watch Now

Key takeaways

- Regulation Driving Change: Section 1033 and forthcoming regulations will revolutionize open banking by mandating greater data-sharing across financial institutions. This will shift the industry from a market-driven to a regulation-driven framework, impacting how data is accessed and controlled. Using APIs and structured data feeds can improve customer service and reliability.

- Consumer-Centric Empowerment: Open banking places power back in the hands of consumers by offering more transparency, control, and personalized experiences. Banks must prioritize “micro moments of delight” to maintain customer loyalty in a more competitive environment. While consumers benefit from increased choice, banks will need to innovate and offer seamless experiences to avoid churn.

- Balancing Compliance with Innovation: The panel explored how financial institutions must address both opportunities and compliance challenges. Implementing cash flow underwriting offers significant advantages, but it also requires careful monitoring to avoid regulatory pitfalls. Ensuring consumer data security and avoiding unintended biases are top priorities in this evolving ecosystem.

- Strategic Partnerships: Open banking demands collaboration across fintechs, banks, and third-party data providers. Banks that prioritize strategic partnerships will have the edge in navigating this complex space, as integration with trusted fintech partners will enable them to offer cutting-edge financial services while maintaining compliance.

Watch all of the Sessions from Cash Flow Underwriting Summit

Watch all of the Sessions from Cash Flow Underwriting Summit

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay. Check out Cash Atlas™ solution.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.