WATCH ON DEMAND

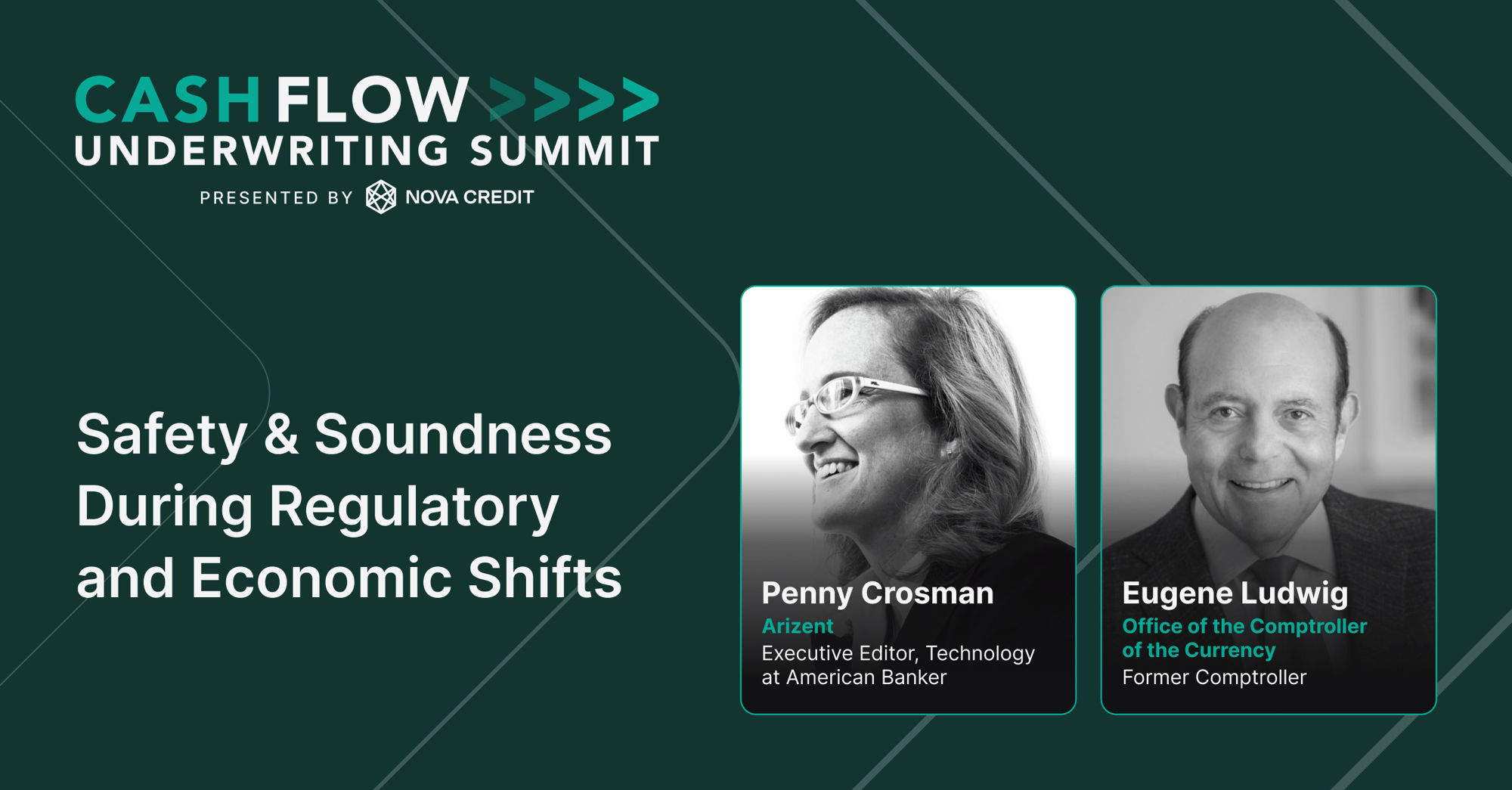

Safety & Soundness During Regulatory and Economic Shifts

In this fireside chat, Penny Crosman sits down with Eugene Ludwig, former Comptroller of the Currency, to explore the intersection of regulatory challenges and economic shifts in the financial industry. They dive into how safety, soundness, and innovation can coexist, and the role of credit decision-making tools in maintaining stability during periods of change. Ludwig brings his vast expertise to the discussion, shedding light on the impact of modern financial tools and regulatory strategies.

Watch Now

Key takeaways

- The Risks of Rigid Credit Models: Ludwig emphasizes the dangers of relying solely on one credit assessment tool, such as FICO scores. He argues that while they provide some predictability, overdependence can limit credit access for many. A more diverse set of tools, such as cash flow data, is essential for better decision-making and broadening credit availability.

- Cash Flow Underwriting as a Tool, Not a Solution: While cash flow underwriting can enhance credit decisions, Ludwig warns it should not be the only measure. The conversation touches on how using cash flow data, particularly in underserved areas, can help lenders get a clearer picture of a borrower's financial health. However, it must be supplemented with other data to ensure fairness and safety.

- The Role of AI and Data in Modern Lending: AI's growing role in lending brings both opportunities and challenges. Ludwig highlights that while AI can improve decision-making by processing vast amounts of data, it's not without risks. The conversation covers the need for caution, ensuring AI models are well understood and do not create unintended discriminatory outcomes.

Watch all of the Sessions from Cash Flow Underwriting Summit

Watch all of the Sessions from Cash Flow Underwriting Summit

Solutions to help you scale faster

Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay. Check out Cash Atlas™ solution.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.